Insurance companies offer various services to their clients but the challenges they face like keeping track of all the records, accounting, claim reminders, and many others are difficult to handle. To smooth these processes and digital transformation, we offer custom insurance software development services for our clients by leveraging automation and elastic & robust IT infrastructure. Our expert developers have experience in serving insurance and reinsurance organizations in policy administration, sales & disbursement processes, claims, billing, brokerage, third-party administration, risk & compliance, and many other services by leveraging advanced technologies and processes like automation, Smart Connected Devices, and Cognitive Systems.

Insurance Software Development Services

Our experts can help you automate and simplify your workflow by developing unique custom insurance software solution to meet your business requirements. With more than 20 years of industry experience in insurance software development, we have served companies with both advancements in existing systems and the development of custom software to utilize technology-driven transitions in the market.

Insurance, Claims & services

Our solutions make buying insurance, policy handling, and claims management effortless.

Reinsurance Solutions

We develop reinsurance solutions to simplify settlement management and operations tracking.

Pension Fund Solutions

Our pension fund management systems help to maximize the benefits of pension schemes.

Pension Funds Solution

Our Pension Funds Management solution helps users to yield maximum benefits from their pension schemes. It allows users to easily access scheme-specific funding information, risks involved, assets and liabilities in a unified manner. We ensure all the functionalities are automated, performed in real-time, and securely integrate with bank accounts.

- Secured Employee and Employer account creation process with mandatory details as per government laws.

- Charge, Lien, and pledge facility for employees who want to take loans against their pension.

- Employee pension certificate, risk profile management, investment funds details, and estimated profits.

- Fund performance comparison and periodic investment switching facilities to employees.

- Custodian bank integration with employer account and distribution of monthly pension to employees.

- Back office support for custodian banks and portfolio management for fund managers of custodian banks.

- Preserved Account management for unaccounted money and its investment portfolio of it.

- Government laws compliance module as well as public inquiries and complaints module.

Digital Insurance

- Life | Long term care | Disability

For Advisors

Leverage our insurance software development expertise in creating software solutions for financial advisors to help them meet the life insurance needs of their clients. Allows clients to easily choose from a range of insurance services like life insurance, long-term insurance, and disability coverage. The single sign-on and e-signature features keep the documentation process streamlined. It also allows insurance services advisors to calculate estimated insurance, its potential insurance coverage that a client can receive using an inbuilt calculator with a comparison sheet displaying insurance products from leading institutions.

For Consumers

Our white-label insurance software development services make it possible for credit unions and banks to sell life insurance on a single platform. The institutions have to simply approve which insurance they would like to sell on the platform and our software integrates it. This gives the customers a holistic view to look at different options from different providers and the power to choose from a wide range of options. At the same time, it increases the visibility and sales revenue of the insurance products offered by different institutions.

Analytics & Insight

Data analysis and tracking of business needs at one place via dashboards created by our insurance software developers support organizations in gaining insights, smarter decision-making, planning, and improving user engagement. It also tracks the status of clients’ policies, preventing policy expirations and lapses along with helping in cross-selling other insurance products. Using this system, users can build stronger relationships with clients, gain a competitive advantage and generate higher business revenue streams.

Corporate Policy & Claims Management Software

Claims Management

Manage and evaluate claims in a hassle-free, cost-effective way using unified Claims Management Solutions. With information at your fingertips, check financial information and gain valuable insights within a click

- First notice of loss maintenance

- Custom Workflow routing

- Claims Correspondence & Management

- Claim Chronology

- Subrogation & Litigation

- Payments

- Diary, Notes and Calendar

- Standard and Bespoke Reporting

- Audit history

- Payable & reconciliation

- Secured Document management

- Insurance claim submission modules

- Integration with EDI, ISO, CMS and many more

Policy Management

Make business critical affairs your priority by leaving it on us to develop an automated, high productive, efficient and compliant insurance software solution that assists your business in every step of policy management

- Quote to issuance workflow

- Bulk policy buying

- Payment management

- Custom Rating Engine

- Lost Cost Tables

- Direct & Agency Billing

- Audits Module

- Renewals for underwriting staff

- Jurisdiction and employee category

- based policy management

- Compliance with Governing laws

- Vendor Management

- Client self service portals

Reinsurance

Reinsurance solutions automate and simplify the process of managing contracts and settlements, making it easier for the primary insurer and insurance companies to keep a real-time track of business operations. Get the capabilities to control, audit, maintain and analyze client’s data on a single platform using advanced reinsurance solutions.

- Audit System

- Treaty & Facultative

- Claim Payments & Major Loss

- Cedant & Brokers Management

- Technical Accounts

- Treaty Management Workflow

- Current Accounts

- Financial Accounts

- Treaty Wise Accounting

- Document Management

- P&L Accounts for Treaty & Fac

- Treaty Renewals & Modifications

- Supports General, Life & Medical Insurance

- Retro Protection with Retro Treaty & Fac

- Coverage Protection & Liability Limitations

- Report Design & Subscription

Insurance Software Development Case Studies

Discovering and analyzing the nitty-gritty of each software development project to achieve measurable outcomes is what we have done as a leading insurance software development company.

Insurance Software Development FAQs

-

How is the Insurance App Development Process initiated?

For insurance app development, we follow a specific process that is divided into the following fundamentals -

- Define the objectives

- Conduct research on the specific requirements

- App Prototype Design

- App Development

- Application Testing

- Application Deployment

- Maintenance and Support

-

What type of services do you offer as an Insurance Software Development Company?

As a proficient insurance software development company, we offer robust and secure app development solutions and consulting services such as -

- Custom Insurance Software Solutions Development

- Claim Management Solution Development

- Reinsurance Solution Development

- Insurance Analytics Solution Development

- Mobility Solutions for Insurance

- Insurance Process Management Solution Development

- Insurance app development consulting services

-

What types of Insurance Software have you developed?

There are various types of insurance softwares, web & mobile applications we have developed for our clients -

- Claims Management Software

- Underwriting Software

- Video eKYC/KYC Solutions

- Insurance Workflow Automation Software

- Policy Management Software

- Document Management Software

- Reinsurance Software

- Pension Management Application

-

How much time does it take for you to develop an Insurance Software?

The time it takes to develop an insurance software is determined based on the client requirements and their complexity. So, before initializing the development process, we go through the objectives and conduct research to design the final prototype for the application.

-

How much does it cost to develop an Insurance app?

The cost to develop an insurance software / application depends upon the functionalities and features that need to be developed and time required. For more details, kindly connect with us at info@tatvasoft.com

-

Do you sign an NDA?

Yes, we do sign an NDA- Non disclosure agreement before initializing the project services to eliminate the possibility of any unethical data breaches and safeguard IPs and vital data of companies.

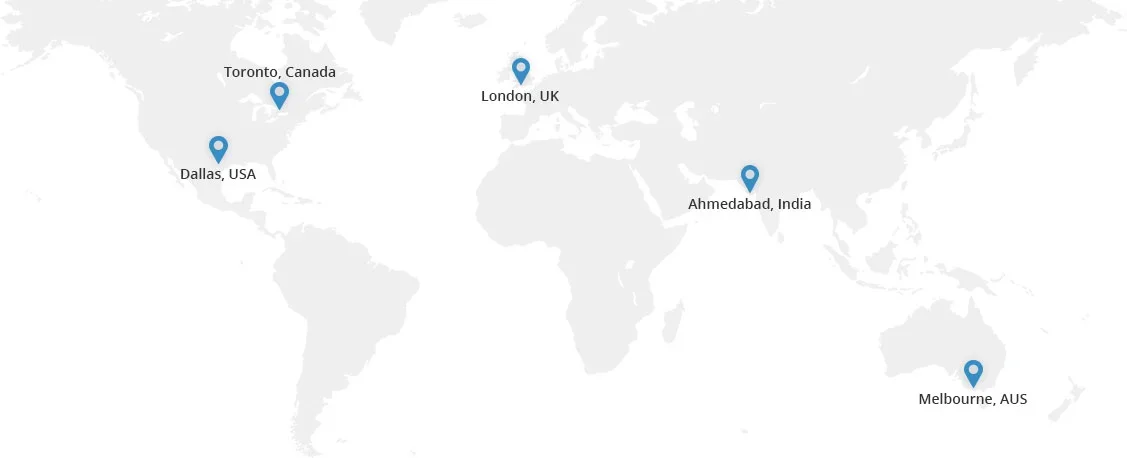

Global Presence

As one of the leading insurance software development companies, TatvaSoft has marked its global presence with offices in six countries, including US, UK, Canada, Australia, Japan, and India with a skilled team specializing in different technologies.

We are tapping into the power of the digital world, creating high-impact insurance software solutions to boost business efficiency and deliver a superior customer experience. TatvaSoft as a custom software development company is committed to provide end-to end customized solutions to our global customers from insurance industry and tackle the technology problems faced by businesses.